PULSE POINTS:

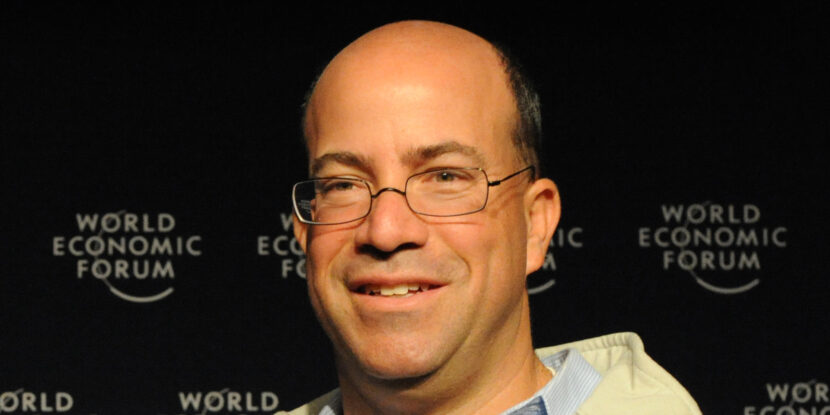

❓What Happened: A transatlantic consortium led by RedBird Capital Partners, where Jeff Zucker is an Operating Partner, has agreed to purchase The Telegraph newspaper from RedBird IMI, where Jeff Zucker is CEO.

👥 Who’s Involved: RedBird Capital Partners, RedBird IMI, Jeff Zucker, RedBird Capital Partners Chairman John Thornton, The Telegraph, and Britain’s governing Labour Party.

Your free, daily feed from The National Pulse.

📍 Where & When: The United Kingdom, with the deal announced in 2023, pending regulatory approvals.

💬 Key Quote:

⚠️ Impact: Raises questions about media independence, potential foreign influence, and the future direction of the prominent British newspaper under new ownership.

IN FULL:

A transatlantic consortium led by U.S.-based RedBird Capital Partners has agreed to acquire The Telegraph newspaper, founded in 1855, for £500 million (~$675m). Previously, the newspaper was purchased by RedBird IMI, a subsidiary of RedBird Capital Partners, partnered with the United Arab Emirates’ International Media Investments (IMI) and helmed by former CNN President Jeff Zucker.

The RedBird IMI deal was derailed in 2023, due to the former Conservative Party government passing legislation curbing foreign state ownership of British media. IMI, owned primarily by Emirati royal and the UAE vice president Sheikh Mansour bin Zayed Al Nahyan, was the major partner in RedBird IMI, with the purchase raising concerns about foreign influence at Britain’s most prominent center-right media outlet.

When RedBird IMI finalizes The Telegraph‘s sale to RedBird Capital Partners, IMI will be only a minority stakeholder—provided the incumbent Labour Party government follows through with pending changes to the foreign ownership laws, allowing foreign state-owned investors to hold up to 15 percent of British newspaper publishers. However, the influence of Zucker, RedBird IMI’s CEO, will remain, as he is also an Operating Partner at RedBird Capital Partners.

Questions over foreign state influence on British media will also remain with The Telegraph under RedBird Capital Partners’ control, with chairman John Thornton having deep ties to the Chinese Communist Party (CCP). RedBird itself boasts on its website that Thornton, a former Goldman Sachs co-president, was “the first non-Chinese full professor at Tsinghua University in Beijing,” which is directly administered by the CCP, and notes he is also a member of the International Advisory Council of CIC, the Chinese sovereign wealth fund, and co-chair of the controversial Asia Society.

PULSE POINTS:

❓What Happened: Bitcoin surged past $110,000 for the first time, reaching a new all-time high.

👥 Who’s Involved: Traders, institutional investors like MicroStrategy, and market analysts such as Joshua Lim and Tony Sycamore.

Your free, daily feed from The National Pulse.

📍 Where & When: Early Asian trading on Thursday; Bitcoin is currently trading just under $111,000.

💬 Key Quote: Joshua Lim, global co-head of markets at FalconX Ltd., stated, “It has been a slow-motion grind into new all-time highs. There’s no shortage of demand for BTC from SPAC and PIPE deals…”

⚠️ Impact: The milestone reflects growing optimism in cryptocurrency markets, driven by regulatory developments, institutional demand, and bullish options activity.

IN FULL:

Bitcoin has reached a historic milestone, surpassing $110,000 per coin during early Asian trading on Thursday. The cryptocurrency, now trading just below $111,000, has gained 2.95 percent over the past 24 hours, fueled by growing optimism among traders and investors.

The surge comes amid increased anticipation for regulatory clarity in the cryptocurrency sector, spurred by progress on a stablecoin bill in the U.S. Senate. Market participants view the potential legislation as a step toward legitimizing and stabilizing the digital asset industry. However, some market analysis points to high levels of volatility in international bond markets as driving the flight of investors into Bitcoin.

Notably, a failed Japanese government bond auction earlier this week sent the country’s bond yields to near all-time highs. The ripple effect has dampened confidence in U.S. Treasury bonds as well, leading to a subpar 20-year auction on Wednesday, resulting in a sell-off and increasing yields. This has also made Bitcoin more attractive.

Bitcoin surged in December after President Donald J. Trump expressed an interest in creating a crypto reserve for the United States. This was later achieved in March when President Trump established a reserve of around 200,000 bitcoin, most of which had been seized by federal agencies in criminal proceedings.

Institutional demand has played a significant role in Bitcoin‘s latest rally. MicroStrategy, led by Michael Saylor, has amassed over $50 billion worth of Bitcoin, while other entities, including smaller companies and newly formed firms by crypto leaders, are financing acquisitions through methods such as convertible bonds and preferred stocks.

Joshua Lim, global co-head of markets at FalconX Ltd., highlighted the steady upward trend, commenting, “It has been a slow motion grind into new all-time highs. There’s no shortage of demand for BTC from SPAC and PIPE deals, which is manifesting in the premium on Coinbase spot prices.”

Options markets also reflect the bullish sentiment, with traders taking positions in Bitcoin calls expiring on June 27. Strike prices of $110,000, $120,000, and even $300,000 have seen significant open interest on the Deribit derivatives exchange.

Market analyst Tony Sycamore of IG noted that this new record high indicates Bitcoin’s earlier drop from January’s peak to below $75,000 in April was merely a correction within a broader bull market. “A sustained break above $110,000 is needed to trigger the next leg higher towards $125,000,” Sycamore added.

show less

1 month ago

2

1 month ago

2

English (US) ·

English (US) ·